26+ Extra payments on mortgage

The time thats left on your mortgage. Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc.

23 Free Bi Weekly Budget Templates Ms Office Documents Budget Planner Template Weekly Budget Template Budget Template

Because you make payments every 2 weeks this results in 26 half payments which is equivalent to 13 monthly mortgage payments.

. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. As a result by the end of. But sometimes banks dont apply your payments correctly costing you money and affecting your finances.

So the purpose of extra payments on the principle balance of the mortgage forces a re. Most banks generally have a fortnightly payment system but you must. Those additional payments toward your mortgage can save you major money in the.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Based on our example above that extra payment can knock four years off a 30-year mortgage and save you over 25000 in interest. It can help you pay off your debt much more quickly.

The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete. With a bi-weekly payment youll be be making 26 payments instead of 12 albeit smaller payments. This lets you pay half your mortgage bill every two weeks instead of once a month.

The net effect is similar to one extra monthly payment 13 per year. Microsoft Excel Mortgage Calculator Spreadsheet Usage Instructions. It can be a good option for those wanting to contribute more money toward a.

When you pay extra payments directly on the principal you are lowering the amount that you are paying interest on. Doing so results in 26 half-payments or 13 full monthly payments each calendar year. With biweekly mortgage payments you make 26 half-payments a year which equates to 13 total payments in a year.

Our Excel mortgage calculator spreadsheet offers the following features. Ask your lender to apply the added payments to your principal. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes.

A biweekly mortgage payment is a mortgage option where instead of 12 monthly payments every year you make half a months payment every 2 weeks. There are 52 weeks in a year. These calculations can also be done in a different order 6100 006 00312 0005.

Making extra principal payments on your mortgage can be a solid financial strategy. We were making extra principal payments and our bank started holding the. Extra Payment Mortgage Calculator By making additional monthly payments you will be able to repay your loan much more quickly.

For example if youve been paying a 30-year mortgage. By the end of each year you will have paid the equivalent of 13 monthly payments instead of 12. After the COVID-19 crisis the FOMC dropped the Fed Funds Rate to zero and issued forward guidance suggesting they would not lift rates through 2023.

Some mortgage servicers let you sign up for biweekly mortgage payments. One option to consider is a biweekly every two week payment plan. The amount of time youve agreed to pay off your mortgage.

2020 has been a record year for mortgage originations as many homeowners refinanced to take advance of low. Allows extra payments to be added monthly. Brenda Well theres usually a grace period so its technically due on the 1st but you can typically pay late until the 15th.

Equity after 10 years. If you actually want to pay less in interest on a traditional mortgage you need to make extra payments to principal. Some loans will take the extra payments you make and apply them to the interest that has accrued since your last payment and then to the principal amount of the loan.

That results in 26 half-payments which equals 13 full monthly payments each year. Nper is short for number of periods and simply represents how many payments you will make on your loan. The real reason it helps pay off your mortgage faster is because your extra payments add up to 13 monthly payments per year.

Here are the advantages of making extra mortgage payments. Colin Robertson May 14 2016 at 826 am. Term of the loan.

Equity after 5 years. When you make extra mortgage payments youre reducing this initial loan. Bi-Weekly plus Extra Mortgage payment.

Bi-weekly Payments for an Auto Loan Calculator Overview. After that you might be looking at a flat. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

Regular mortgage payments are set up such that you pay the same amount each month but the breakdown between principal and interest changes every month. Years to pay off. Ultimately significant principal reduction cuts years off your mortgage term.

So we have 05100 which equals 0005. June 26 2018 by Harry Sit in. If the first few years have passed its still better to keep making extra payments.

If your current rate on a 30-year fixed loan is 4000 would you like to see if you. Monthly payments start on. Biweekly payments accelerate your mortgage payoff by paying 12 of your normal monthly payment every two weeks.

For example a 30-year mortgage would have a loan term of 30 years. September 11 2022 Monthly mortgage payments. For a monthly payment this.

So youre basically making. Terry I feel the same way. Extra payments count even after 5 or 7 years into the loan term.

The calculator updates results automatically when you change. When you have a mortgage at some point you may decide to try and pay it off early. Since you would pay 26 biweekly payments by the end of a year you would have paid the equivalent of one extra monthly payment.

If you pay every 2 weeks thats 26 half payments. There are multiple extra payments that you can include such as one time additional payment or recurring extra payments. You first pay the interest calculated from the previous balance.

This will be your monthly interest you will use to calculate mortgage payments. Your savings primarily come from the fact that paying every other week means youll be making 26 half-payments a year the equivalent of 13 monthly payments. Total Tax Insurance PMI Fees.

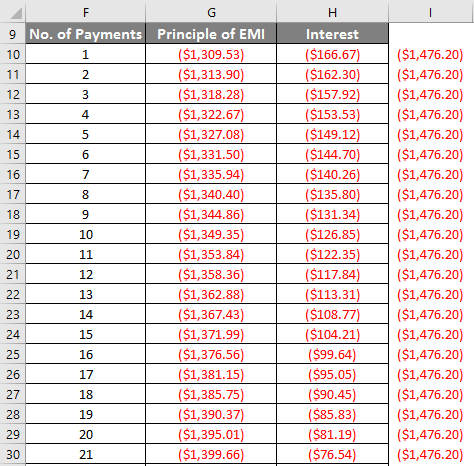

Before taking a fortnightly option be sure to arrange it with your lender first. Amortization Schedule with Extra Payments excel to calculate your monthly mortgage payment with extra payments. The calculator lets you find out how.

In addition to making extra payments another great way to save money is to lock-in historically low interest rates. You can save on interest charges by making extra payments. Extra Payment Mortgage Calculator.

Biweekly mortgage calculator with extra payments excel to calculate your mortgage payments and get an amortization schedule in excel. Shows total interest paid. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

This method adds an extra months payment every year that is applied to your mortgages principal helping you shave years off your mortgage repaymentIn fact it can help you pay off your mortgage early by 6. 58126 37357 Apr-11-2029 Payment 80 95483 58002 37481 May-11-2029. Stan Page November 10 2021 at 1026 am - Reply.

16 Free Weekly Budget Templates Ms Office Documents Weekly Budget Template Budgeting Budget Template

Simple Loan Contract Template 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References On Wh Contract Template Business Loans Loan

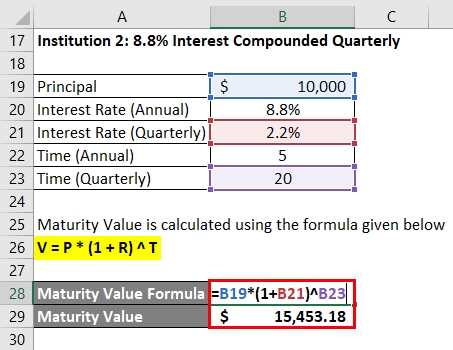

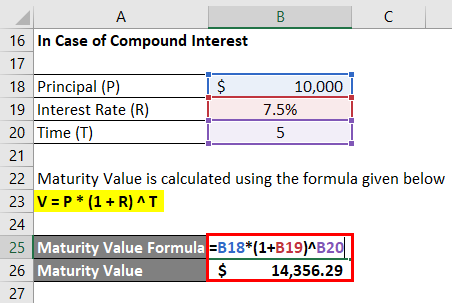

Maturity Value Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

Loan Agreement Template Format Free 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References Contract Template Loan Personal Loans

Printable Sample Loan Template Form Contract Template Student Loans Templates

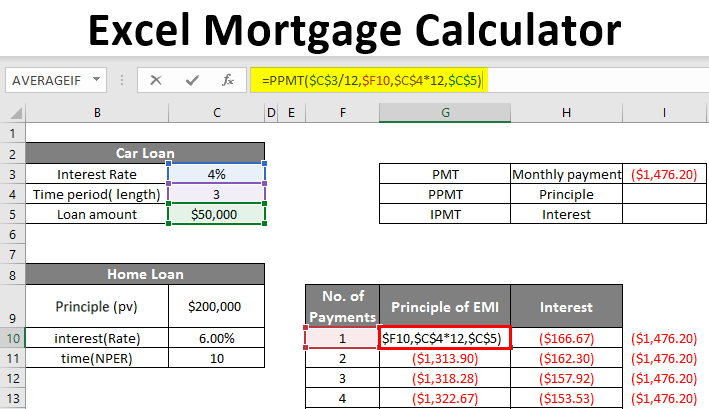

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Loan Contract Modification Request 26 Great Loan Agreement Template Loan Agreement Template Is Needed As References On What To D Loan Agreement Best Loans

26 Great Loan Agreement Template Letter Of Recommendation Format Contract Template Agreement

26 Great Loan Agreement Template Contract Template Templates Agreement

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

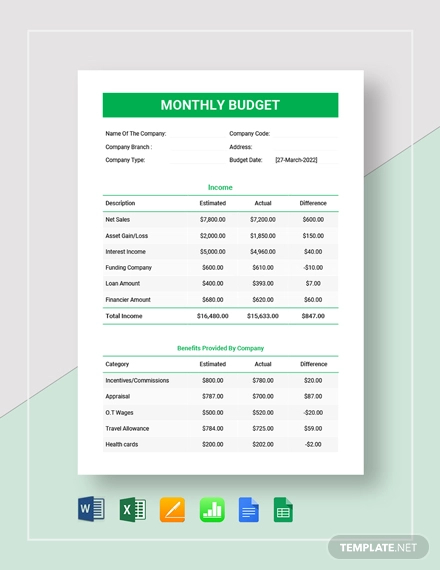

Monthly Budget 26 Examples Format Pdf Examples

23 Free Bi Weekly Budget Templates Ms Office Documents Budget Planner Template Weekly Budget Template Budget Template

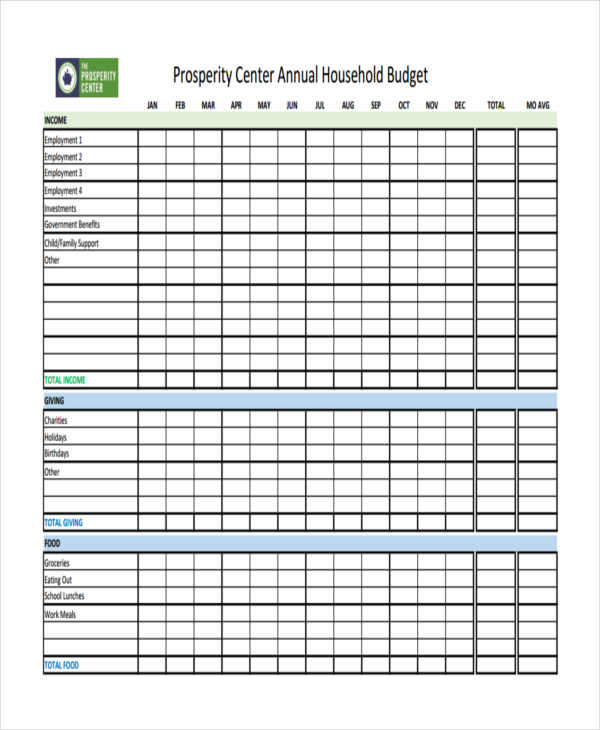

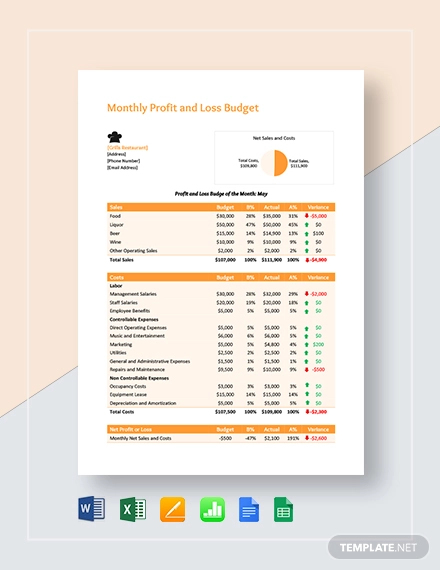

26 Budget Templates In Pdf Free Premium Templates

26 Great Loan Agreement Template Contract Template Loan Best Loans

Monthly Budget 26 Examples Format Pdf Examples

Equipment Loan Contract Form 26 Great Loan Agreement Template Loan Agreement Template Is Needed As Refer Invoice Template Word Contract Template Templates